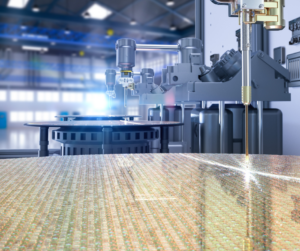

The IRS recently proposed regulations which clarify the Advanced Manufacturing Investment Credit. Established by the Creating Helpful Incentives to Produce Semiconductors Act of 2022 (commonly referred to as the CHIPS Act), the credit incentivizes the production of semiconductors and semiconductor manufacturing equipment in the US.

For qualified property placed in service after Dec. 31, 2022, the credit for any taxable year is usually 25% of the qualified investment in the advanced manufacturing facility, and the property must be integral to the operation of the facility. Eligible taxpayers have the alternative option to receive the credit as an elective payment, which would be applied as a payment against the tax liability equal to the amount of the credit. Partnerships or S corporations can receive a payment rather than claiming the credit.

The proposed regulations impact eligibility requirements for the credit, as they will define key terms such as “eligible taxpayer”, “qualified property”, and “advanced manufacturing facility”. They also provide updated instructions on how to properly claim the credit.

The full IRS news release contains additional details, and the proposed regulations are available for public comment at the federal registrar website.

Contact your HW&Co. advisor if you’d like to learn more about claiming the Advanced Manufacturing Investment Credit.

©2023