PRF Background

PRF Background

Our last 2 updates Provider Relief Fund (PRF) Reporting Portal is Now Open and Revised PRF Reporting Requirements including Extended Time to Expend Some Funds provide some important background. In this article, we have an update to Single Audit Requirements based on recent HHS updates to the Provider Relief Funds Frequently Asked Questions (FAQs) and a draft of the Office of Management and Budget (OMB) 2021 Compliance Supplement section for PRF.

Single Audits of FYEs Prior to June 30, 2021

Single audits of nonfederal entities with PRF funding that have been on hold can now be completed. PRF will be excluded from the scope of single audits of nonfederal entities with FYEs ending on December 31, 2020, through June 29, 2021 (PRF will not be included on the Schedule of Expenditure of Federal Awards (SEFA) for these FYEs). A new HHS FAQ posted on July 15 states that nonfederal entities will include PRF expenditures and/or lost revenues on the SEFA for FYEs ending on or after June 30, 2021. HHS confirmed that this new guidance supersedes previous guidance in the 2020 OMB Compliance Supplement Addendum which had stated that PRF reporting would begin on SEFAs for December 31, 2020, and later FYEs.

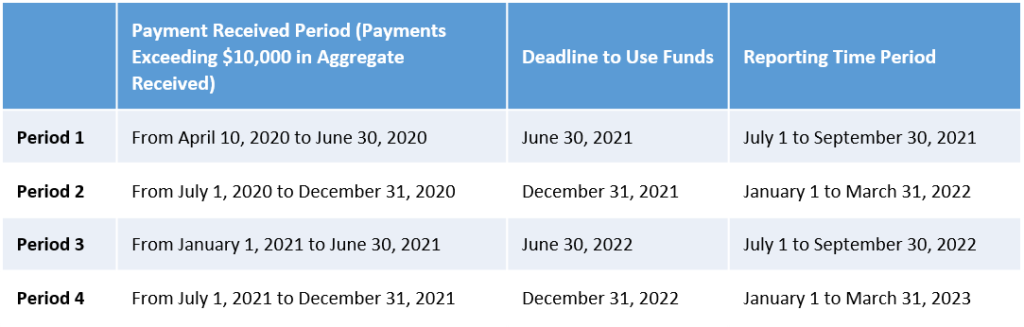

Single Audits of FYEs on or After June 30, 2021HHS confirmed that the reporting of PRF on the SEFA continues to be tied to the amounts reported in the PRF Reporting Portal. In the updated PRF FAQs, HHS establishes that the reporting in the PRF Reporting Portal will be based on when PRF was received and that PRF recipients must only use payments for eligible expenses. This includes services rendered and lost revenues during the period of availability (also known as period of performance), as outlined in the table below. |

Because the goal of HHS is to link the SEFA reporting for PRF to the report submissions to the PRF Reporting Portal, HHS also clarified in an FAQ posted on July 15 that reporting of PRF on the SEFA will be as follows:

Reporting to the PRF Reporting Portal is based on the payment received period and early reporting is not allowed. Therefore, even if all PRF funding has been fully expended by a recipient as of June 30, 2021, the reporting to the PRF Reporting Portal and the timing of PRF SEFA reporting is based on the table and guidance above. One important change from the 2020 Compliance Supplement will be the inclusion of a detailed list of key line items in the PRF Reporting Portal submission on which auditors will focus when auditing the reporting type of compliance requirement. Also, the PRF section of the 2021 Compliance Supplement will advise that since the PRF report is to be tested as part of the reporting type of compliance requirement, auditors should consider delaying the commencement of the compliance audit of the PRF program until recipients have completed the PRF report. The table above identities the timeframes that the PRF Reporting Portal submission is required to be made. So, for example, nonfederal entities with June 30, 2021, FYEs that are required to make Period 1 PRF Reporting Portal submissions would do so beginning July 1, 2021, but no later than September 30, 2021. Audits of For-Profit Recipients of PRFThe impact and relevance of the above guidance on for-profit recipients of PRF funding is yet to be determined. We believe HHS will develop additional guidance addressing for-profit considerations. |