At the time of initial publication, the enhanced provider relief portal was only for the Medicaid, CHIP and Dental providers but it has since been expanded to include the “second chance” providers and private pay assisted living facilities . Since the article, the application has been simplified slightly but the process remains the same.

Our June 11, 2020 article discusses the eligibility requirements for the Medicaid Targeted Distribution (MTD) and provides an overview of the application.. On June 25, 2020, HHS added two new pages of FAQs mostly related to the Medicaid Targeted Distribution. This article provides more detail on the step-by-step submission process and offers some useful tips from the CARES ACT Provider Relief Fund Payment Portal User Guide. We believe additional guidance will be coming and providers should check HHS FAQs for the latest updates before submission.

ACTION REQUIRED:

Validate TIN as soon as possible (Steps 1-5)

Submit application by September 13, 2020 (Step 6)

The following are the steps to apply for the MTD through the enhanced provider relief portal:

- Sign in or Create an Optum ID

-

- If you do not have an Optum ID, you will need to create an Optum ID to access the portal.

- If you have an Optum ID already, you can access the portal at the top right of the webpage to sign in.

- Sign Up for Updates

-

- Must provide email address to be used for confirmation emails.

- Be sure not going to spam folders.

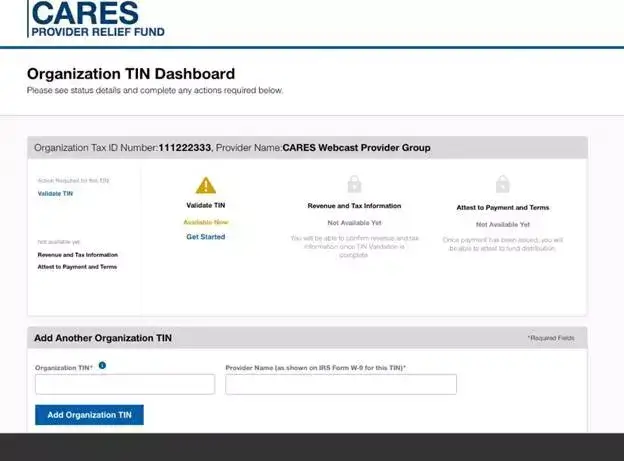

- Add Organization Taxpayer Identification Number (TIN)

-

- Name has to be exactly as on IRS Form W-9.

- This should be the entity’s organization TIN (“Filing TIN”) you will use in applying for relief funds.

- An Organization TIN files a tax return but may not bill Medicare or Medicaid directly.

- The Organization TIN may have one or more subsidiaries that do not file tax returns (disregarded or consolidated entities).

- All of the subsidiary TINs will be listed in the applicable field within the application form.

- Program Administrator Attestation

-

- This administrator accepts responsibility to act on behalf of their organization.

- Only one person can be Program Administrator and go into the portal to submit application so make sure the right person signs up.

- Validate Taxpayer Identification Number (TIN)

-

- Verify information from your W-9 and enter the requested information.

- If TIN is on the curated list, TIN Validation can take 1-2 business days to process.

- If TIN is not on the curated list of state-submitted eligible Medicaid providers, it will be flagged as invalid. In these cases, HHS will work with the states to verify whether the TIN should be included as a valid Medicaid provider in good standing. HHS will notify these providers of their finding within 15 business days. If the TIN is subsequently marked as valid, the provider will be notified to proceed submitting data into DocuSign.

- A healthcare provider must submit their TIN for validation by September 13,2020. If they receive the results of that validation after September 13, they will still be able to complete and submit their application.

Note: Once the TIN is validated, the yellow triangle ![]() will turn into a green check

will turn into a green check![]() and the “Revenue and Tax Information” section of the portal (pictured below) will be open so you can proceed submitting data into DocuSign in Step 6.

and the “Revenue and Tax Information” section of the portal (pictured below) will be open so you can proceed submitting data into DocuSign in Step 6.

- Revenue and Tax Information – Will only be available after TIN is validated

-

- This will be a DocuSign document in which you fill out the application fields and upload required information.

- Several fields will automatically populate on the form. This is based on information completed in previous steps of the program. They are un-editable.

- The provider will be required to complete all items in RED.

- Fields with GRAY boxes are optional.

- Tooltips with additional instructions appear to the provider as they hover over each field. In addition, our June 11, 2020 article provides details as to what is required for most fields.

- The FTE Worksheet is required for upload. However, you only need to list “Primary Providers” which includes physicians, dentists, nurse practitioners, physician assistants and midwives if these are not under a supervisory relationship with a physician. Some providers (i.e. Assisted Living, ICF-IID, HCBS) will not have any primary providers to list; therefore, you should complete the name and number field and upload the worksheet with zero FTEs which will agree to Field 31.

- The Gross Revenue Worksheet is optional and only needs uploaded if you have gross revenue adjustments and enter an adjusted gross revenue number different from the applicable number shown on the tax return.

- There may be lag between the time you receive email confirmation of your submitted application and the portal showing it as complete.

- Attest to Payment and Terms – Will only be available after payment is issued

-

- Within 90 days of receiving this payment, you must sign an attestation confirming receipt of the funds and agreeing to the Terms and Conditions of payment.

- Should you choose to reject the funds, you must also complete the attestation to indicate this. The CARES Act Provider Relief Fund Payment Attestation Portal will guide you through the attestation process to accept or reject the funds.

- Not returning the payment within 90 days of receipt will be viewed as acceptance of the Terms and Conditions.

- Payments will be issued on a rolling basis with expected disbursements to begin by the end of August.

- United Health Care will be sending out payments electronically. Providers also have the option to receive the funds by check.

You should not apply until you have assembled all of the information and documentation required by the application form. You can only submit one application. You cannot edit the data on the application form after it is submitted. The provider support line is (866) 569-3522.

- Read the Medicaid Provider Distribution Instructions

- Download the Medicaid Provider Distribution Application Form

The HHS guidance on the provider relief funds has been ever changing and often conflicting. HW&Co. is here to assist you in any way we can. Please visit the HW&Co. Current Events Center on our website for additional resources or contact your HW&Co. healthcare advisor if you need assistance.

![]()

Disclaimer: Information in this article is subject to change and is based upon our current understanding as of the issue date. This is a constantly evolving process as HHS has been issuing new or changed guidance on a frequent basis.