In February, several changes were made to the Paycheck Protection Program (PPP). On March 3, 2021, the Small Business Administration (SBA) released an interim final rule (IFR) providing guidance on those changes. They also issued new/updated application forms and updated the frequently asked questions (FAQs) on their site.

In February, several changes were made to the Paycheck Protection Program (PPP). On March 3, 2021, the Small Business Administration (SBA) released an interim final rule (IFR) providing guidance on those changes. They also issued new/updated application forms and updated the frequently asked questions (FAQs) on their site.

This new guidance addresses borrowers who file Schedule C (sole proprietors, self-employed individuals and contractors,) now allowing them to use either gross or net income when figuring their PPP loan amount.

The option to use either gross or net income is available to both first draw and second draw loans.

Schedule C Maximum PPP Loan Amount Updates

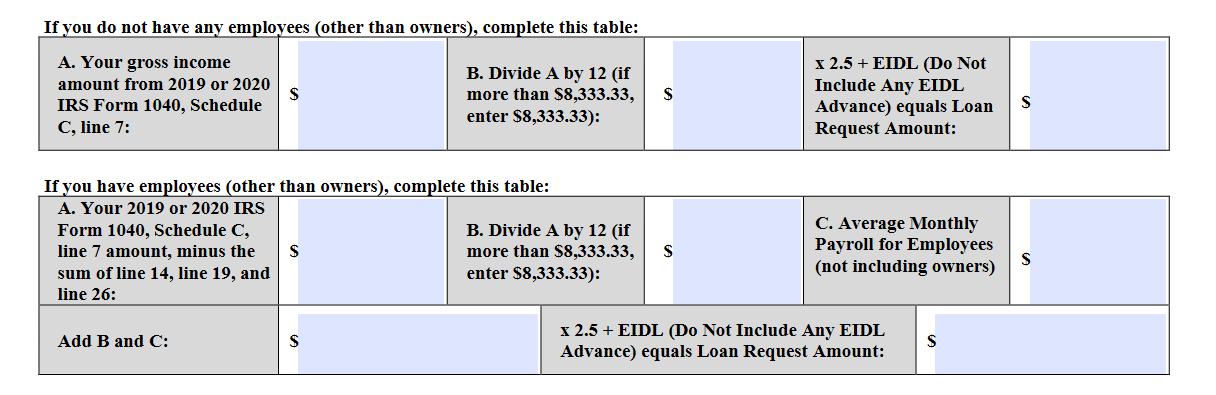

For first draw loans made in 2020, the 2019 Schedule C is used. For first draw loans made in 2021 and all second draw PPP loans, the borrower can elect to use either their 2020 or 2019 Schedule C. The calculations are as follows, (taken from the application form):

These calculation changes only apply to loans approved after the IFR effective date, March 3, 2021. Any borrower, who has already had their loan approved, may not increase their loan amount based on these new formulas.

These calculation changes only apply to loans approved after the IFR effective date, March 3, 2021. Any borrower, who has already had their loan approved, may not increase their loan amount based on these new formulas.

Note: As an anti-abuse measure, borrowers with reported gross income greater than $150,000 may be subject to additional SBA review. If a Schedule C filer elects to use gross income in the limitation calculation, and such amount is greater than $150,000, the borrower will not automatically be deemed to have made the required certification concerning the necessity of the loan request in good faith and may be subject to review of the certification by the SBA. The SBA felt these borrowers may be more likely to have other available sources of liquidity to support their business’s operations.

New/Updated Forms

- Form 2483-C – New loan application form for Schedule C filers that elect to use gross income to calculate the PPP loan amount for a first draw loan. (There is no mention in the form or instructions that the borrower is not deemed to automatically meet the economic necessity certification safe harbor if gross income is more than $150,000.)

- Form 2483-SD-C – New loan application form for Schedule C filers that elect to use gross income to calculate the PPP loan amount for a second draw loan.

- Form 2483 – General loan application form for first draw loans. The instructions for the number of employees to report on page one has been updated to clarify that applicants may use their average employment over the time period used to calculate aggregate payroll costs, or may elect to use the average number of employees per pay period in the 12 completed calendar months prior to the date of the loan application.

- Form 2483-SD – General loan application form for second draw loans. The changes are the same as were made to the first draw application (Form 2483).

Changes to Loan Forgiveness Calculations for Schedule C Borrowers

The election to use gross income in the loan amount calculation produced a change to the forgiveness calculations for Schedule C borrowers.

If a borrower uses the Schedule C net profit, there are no changes to the previously published limitations and calculations of “owner compensation replacement.”

If gross income is elected, a new term, “proprietor expenses,” and calculation is used to determine the owner compensation replacement.

- If there are no employees, proprietor expenses equal the gross income.

- If there are employees, proprietor expenses equal gross income less payroll expenses (lines 14, 19, and 26 of Schedule C).

- Once the owner replacement amount is calculated using either the net profit or the proprietor expenses, the limitation calculation is modified as well.

- If gross income was used, the limitation is based on the gross income (limited to the $100,000) prorated to the selected covered period, but in all events, limited to 2.5 months of the 2019 or 2020 gross income (up to $20,833).

If you have any questions about these PPP loan changes, please contact your HW&Co. advisor.