Breaking News: HHS has just provided more guidance on Provider Relief Fund (PRF) reporting and revised the Reporting Requirements. This new version supersedes all previous versions of the Post-Payment Notice of Reporting Requirements documents.

Breaking News: HHS has just provided more guidance on Provider Relief Fund (PRF) reporting and revised the Reporting Requirements. This new version supersedes all previous versions of the Post-Payment Notice of Reporting Requirements documents.

Key updates include:

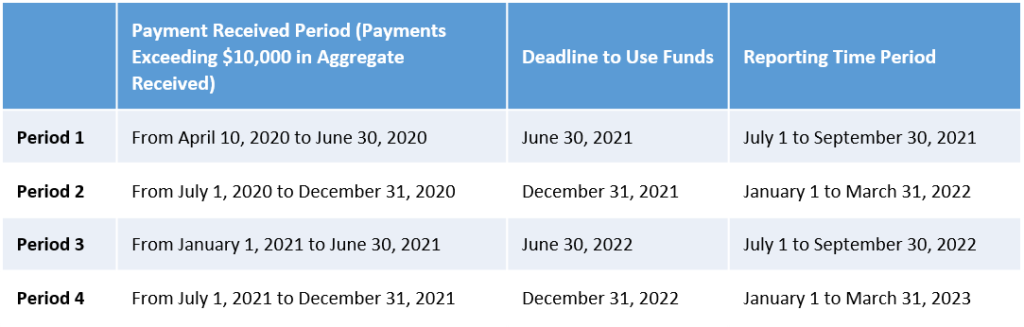

- The period of availability of funds is based on the date the payment is received (rather than requiring all payments be used by June 30, 2021, regardless of when they were received). The time period to expend the funds has been extended beyond June 30, 2021 for any payments received after June 30, 2020.

- The reporting requirements are now applicable to recipients of the Skilled Nursing Facility and Nursing Home Infection Control Distribution in addition to General and other Targeted Distributions

- Recipients are required to report for each Payment Received Period in which they received one or more payments exceeding, in the aggregate, $10,000 (rather than $10,000 cumulatively across all PRF payments).

- Recipients will have a 90-day period to complete reporting (rather than a 30-day reporting period).

- The PRF Reporting Portal will open for providers to start submitting information on July 1, 2021.

Summary of Reporting Requirements

Recipients who received one or more payments exceeding $10,000 in the aggregate during a Payment Received Period are required to report in each applicable Reporting Time Period as outlined in the table above.

All recipients of Provider Relief Fund (PRF) payments must comply with the reporting requirements described in the Terms and Conditions and specified in directions issued by the Secretary.

The original recipient of a Targeted Distribution payment is always the Reporting Entity. A parent entity may not report on its subsidiaries’ Targeted Distribution payments. The original recipient of a Targeted Distribution must report on the use of funds in accordance with the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA). This is required regardless of whether the parent or subsidiary received the payment or whether that original recipient subsequently transferred the payment. A Reporting Entity that is a subsidiary must indicate the payment amount of any of the Targeted Distributions it received that were transferred to/by the parent entity, if applicable. Transferred Targeted Distribution payments face an increased likelihood of an audit by HRSA

Providers are encouraged to register in the PRF Reporting Portal in advance of the relevant Reporting Time Period dates. The registration process will take approximately 20 minutes to complete and must be completed in one session. The entire registration form must be completed for it to be saved.

These reporting requirements will not apply to recipients of funds from Rural Health Clinic COVID-19 Testing Program and HRSA’s COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing, Treatment, and Vaccine Administration for the Uninsured Program or COVID-19 Coverage Assistance Fund.

We will keep you posted as more is known. HW&Co. is here to assist you in any way we can. Please visit the HW&Co. Current Events Center on our website for additional resources or contact your HW Healthcare Advisor if you need assistance.

Disclaimer: Information in this article is subject to change and is based upon our current understanding as of the issue date. This is a constantly evolving process as HHS has been issuing new or changed guidance on a frequent basis.