Background Information:

Background Information:

The Coronavirus Aid, Relief, and Economic Security Act (CARES) Act that was signed by the President on March 27, 2020 included a Provider Relief Fund Payment provision of $100 billion to go to health care providers affected by COVID-19. By now, most of you have received two rounds of distributions, and it goes without saying that all of you have been affected.

The Department of Health and Human Services (HHS) split the funds into two equal groups: $50 billion for “General Distribution” which encompassed most health care providers, and $50 billion for “Targeted Distribution”, whose recipients are more narrowly defined, and include primarily hospitals and other specific groups, such as Medicaid-only skilled nursing facilities.

Round 1 distributed $30 billion between April 10th and April 17th. This distribution was based on a provider’s Medicare Fee for Service reimbursements for 2019. It was likely based on most recent claims data per the provider’s most recent Provider Summary Report (PSR).

Round 2 distributed an additional $20 billion on April 24th. The methodology for this distribution was different in that it was based on 2018 data. Total net patient revenue (including all payer types, not just Medicare) was multiplied by 2%; this is the amount each provider should have received in total for Rounds 1 and 2. This amount was compared to what the provider received in Round 1, and providers received the difference as the Round 2 payment. Some providers did not receive anything in Round 2 if they were overpaid in Round 1.

In order to see if your Round 1 and 2 funding was correct, use the following formula:

- Skilled Nursing Facilities:

- 2018* Medicare cost report Worksheet G-3, Line 3 x 2% = total received Round 1 and 2

- Home Health Agencies:

- 2018* Medicare cost report Worksheet F-1, Line 3 x 2% = total received Round 1 and 2

- Hospice:

- 2018* Medicare cost report Worksheet F-2. Line 8 x 2% = total received Round 1 and 2

*Assumes calendar year provider. Fiscal year may use most recent filed (i.e. June 30, 2019) cost reports.

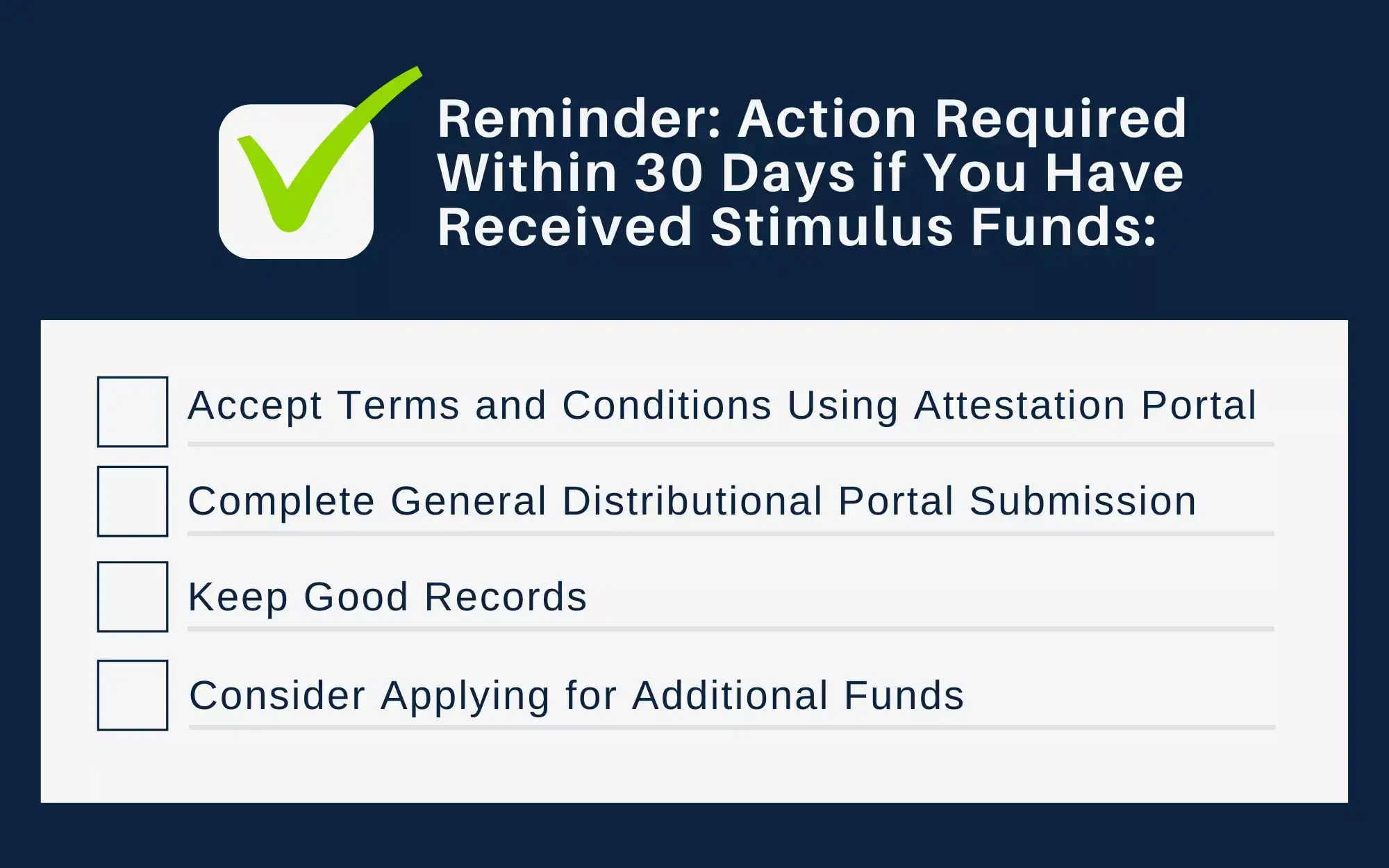

Accept Terms and Conditions Using Attestation Portal:

Accept Terms and Conditions Using Attestation Portal:

Action required within 45 days of receiving funds

All providers receiving funds in Rounds 1 and 2 are required to log in to the Provider Relief Fund Attestation Portal to accept the terms and conditions of the payment. This must be done within 45 days of receiving the payment(s). The terms and conditions are different for the first and second round of payments. Terms and Conditions for each type of payment can be found here. (5/7/20 Update: HHS extended the deadline from 30 to 45 days)

![]()

Complete General Distribution Portal Submission:

Action required

All providers who received funds on or before April 24, 2020 must also use HHS’s General Distribution Portal to submit revenue and other required information. The information is the same four items detailed in the applying for additional funding section below.

Medicare providers who received funding in Round 1 but for whom HHS did not have adequate cost report data on file to make a payment for Round 2 will need to submit the required information to the General Distribution Portal to be able to receive additional general distribution funds and agree to the terms and conditions for this additional distribution.

Providers who did not receive payments on or before April 24, 2020 are not eligible to use the General Distribution Portal at this time but may be eligible for future payments from the Provider Relief fund.

![]()

Keep Good Records:

Ongoing action required

The terms and conditions discuss providing supporting documentation of expenses and/or lost revenue, but there is no specific detail provided – -yet. Please keep good records!

The attestation form includes a statement on how HHS will determine appropriate use of payments via reporting requirements including maintaining an accounting of payments, and how providers are processing payments from the Fund.

The Terms and Conditions requires:

- The Recipient certifies that the Payment will only be used to prevent, prepare for, and respond to coronavirus, and shall reimburse the Recipient only for health care related expenses or lost revenues that are attributable to coronavirus.

- The Recipient certifies that it will not use the Payment to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.

The general distribution portal FAQs states that care does not have to be specific to treating COVID-19.To be eligible for the general distribution, a provider must have billed Medicare in 2019 and provide or provided after January 31, 2020 diagnoses, testing, or care for individuals with possible or actual cases of COVID-19. HHS broadly views every patient as a possible case of COVID-19.”

You should be tracking your expenses and use of funds so that you are prepared when the reporting mechanism is in place. It may be helpful to set up separate general ledger accounts to track COVID-19 expenses that are in excess of your usual and customary expenses. For example, bonuses, incentive pay agency usage, personal protection equipment, additional housekeeping and/or laundry, etc. We will provide more details as they become available.

![]()

Consider Applying for Additional Funding:

Action required as soon as possible

Based on the most recent HHS general distribution portal FAQs, providers may have the opportunity to request additional funding in excess of their Rounds 1 and 2 distributions by submitting an application to the Provider Relief Fund Application Portal. HHS has put together a CARES Act Provider Relief Fund Application Guide that walks providers through the application process.

At this time, it is uncertain as to how much of the $50 billion is left; however, we recommend that providers consider applying. The provider must have received funds in one of the first two rounds in order to be eligible.

Providers will need to upload the following information to the Provider Relief Fund Application portal:

- “Gross Receipts or Sales” or “Program Service Revenue” per federal income tax return

- Estimated revenue losses in March and April 2020 due to COVID-19

- Copy of most recently filed federal income tax return

- A listing of taxpayer ID numbers for any provider subsidiary organizations that have received relief funds but do not file separate tax returns

Item 2 is the only one that should require calculations. Although guidance is short on specifics, it suggests that providers use a “reasonable” method to substantiate lost revenue; including comparing March and April actual data to budget or to the same period last year. Again, keeping good records to substantiate the methodology that was used is important.

We recommend filing for this additional funding as soon as possible; the data requested needs to ultimately be provided to the portal as part of the “Terms and Conditions” for the Round 2 payment anyway, but submitting it sooner may secure more funding.

HHS has indicated that applications will be processed each Wednesday, but that funds will not be disbursed on a first-come first-served basis. Funds are to be distributed or the application will be denied within 10 business days of submission.

Lastly, on April 24, 2020, the Paycheck Protection Program and Health Care Enhancement Act was signed into law. The Act include an additional $75 billion for healthcare provider relief. The Act uses the same terminology as the CARES Act and gives HHS the discretion to determine how to distribute the funds. It is unknown at this time what providers will be eligible for these funds.

![]()

FEMA Public Assistance Program:

Under the COVID-19 Emergency Declaration, FEMA may provide assistance for emergency protective measures. However, FEMA will not duplicate any assistance provided by HHS so providers receiving the stimulus money are not eligible.

![]()

Healthcare providers are facing challenges and uncertainties beyond what we have ever seen before. As you know, this is a fluid situation that is changing on a daily basis. Please visit the HW&Co. Current Events Center on our website for additional resources. HW&Co. is here to assist you in any way we can. Please contact us if you need assistance.

Disclaimer: Information in this article is subject change and is based upon our current understanding as of the issue date. This is a constantly evolving process as HHS has been issuing new or changed guidance on a frequent basis.