Phase 4 Payments

Phase 4 Payments

On December 14, 2021, the Health Resources and Services Administration (HRSA) announced the distribution of approximately $9 billion in Provider Relief Fund (PRF) Phase 4 payments to health care providers who have experienced revenue losses and expenses related to the COVID-19 pandemic. Payments will start to be made this week. The total Phase 4 allocation is $17 billion, leaving $8 billion to be distributed in 2022 to remaining providers. The PRF Phase 4 payments are in addition to the $8.5 billion in American Rescue Plan (ARP) Rural payments to providers and suppliers who serve rural Medicaid, Children’s Health Insurance Program (CHIP), and Medicare beneficiaries.

Approximately 75% of Phase 4 funding is being distributed based on expenses and decreased revenues from July 1, 2020 to March 31, 2021. HRSA is reimbursing a higher percentage of losses and expenses for smaller providers, which generally entered into the COVID-19 pandemic on worse financial footing, have historically operated on slimmer financial margins, and typically care for more vulnerable populations, as compared to larger providers. HRSA is distributing 25% of Phase 4 funding as “bonus” payments based on the amount and type of services provided to Medicare, Medicaid, or CHIP patients. Similar to the ARP Rural payments announced last month, HRSA is using Medicare reimbursement rates in calculating these payments to mitigate disparities due to varying Medicaid reimbursement rates. HRSA is currently reviewing the remaining Phase 4 applications and will make the remainder of Phase 4 payments in 2022.

Providers will receive one consolidated payment that includes the total amount of any base payment and/or bonus payment you qualified for, based on the information in your application and administrative claims data.

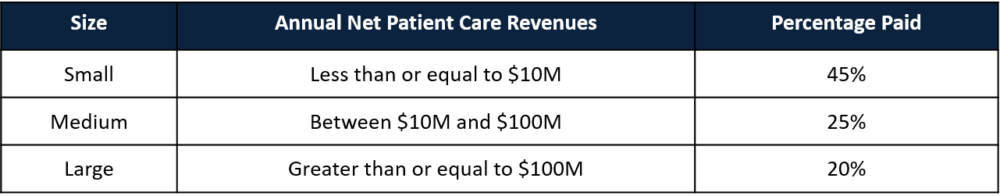

- Base payments are calculated as a percentage of expenses and revenues reported in your application for the period from July 1, 2020 to March 31, 2021. Percentages are determined by provider size as follows:

NOTE: A provider may receive less than the full percentage for their size because HRSA also deducted prior payments not previously deducted in Phase 3.

- Bonus payments are calculated based on Medicare, Medicaid, and CHIP administrative claims data from January 1, 2019 through September 30, 2020. HRSA then adjusted the claims to the available funds, resulting in bonus payments of approximately 0.3% of the provider’s total Medicare, Medicaid, and CHIP administrative claims. More detailed information on payment methodology is available here.

HHS has updated the Terms and Conditions for Phase 4 and ARP Rural payments to ensure relief funds are being used to address the financial impact of COVID-19. Recipients whose payment(s) exceed $10,000 are required to notify HHS of a merger with or acquisition of any other healthcare provider. Providers who report a merger or acquisition may be more likely to be audited to ensure compliant use of funds. As with all previous PRF distributions, within 90 days of receiving a payment, recipients must sign an attestation confirming receipt of the funds and agreeing to the Terms and Conditions of payment by re-entering the Provider Relief Fund Application and Attestation Portal.

ARP Rural Payments

As we previously reported, ARP Rural payments began on November 23, 2021, and 4% of applications were not yet processed, representing $1.1 billion or 13% of the total ARP Rural distributions. Those applications may still be processed due to the size of the award, Optum Account ID challenges, pending denials, or the need for manual review including those with complex organizational structures. Providers should contact the Provider Support Line at (866) 569-3522 to request an application status update if they still have not received their ARP Rural payment in early to mid-January.

Reporting Portal Reopened for Period 1

The Reporting Portal will be open for the completion or submission of reports for Reporting Period 1 from December 13, 2021, at 9:00 am ET to December 20, 2021, at 11:59 pm ET. Providers who contacted the Provider Support Line about problems with a submission should have received an email notifying them that the Portal is reopened. Additionally, PRF recipients who submitted a Reporting Period 1 report, but need to correct an error, may contact the Provider Support Line (866-569-3522) to gain access to their submitted report. Resubmitted reports must also be received by December 20, 2021 at 11:59 pm ET.

As a reminder, the Reporting Portal will open for Period 2 reporting on January 1, 2022. This includes PRF payments received from July 1, 2020, to December 31, 2020, with the deadline to use funds of December 31, 2021. The Period 2 report is due by March 31, 2022. For additional information about PRF reporting, read past HW&Co. articles, visit the HRSA reporting webpage, or contact an HW&Co. Healthcare Advisor.

PRF Frequently Asked Question (FAQ) Updates

The PRF FAQs were updated on December 9, 2021, for the first time since October 26, 2021. Updates include the following:

- Provider Relief Fund recipients must immediately notify HRSA about their bankruptcy petition or involvement in a bankruptcy proceeding so the Agency may take the appropriate steps.

- The Terms and Conditions for Phase 4 and ARP Rural require that recipients who receive payments greater than $10,000 notify HHS during the applicable Reporting Time Period of any mergers with or acquisitions of any other health care provider that occurred within the relevant Payment Received Period. HRSA considers changes in ownership, mergers/acquisitions, and consolidations to be reportable events.

- Modified a prior FAQ, to add that if the seller’s Medicare provider agreement and TIN were accepted by the purchaser in the transaction, a provider who purchased, merged with, or consolidated with another entity (purchaser/new owner) in 2019, 2020, 2021, or 2022 can accept a Provider Relief Fund payment from a seller/previous owner, and complete the attestation for the Terms and Conditions.

- State and federal tax credits (e.g., employee retention tax credits) are not considered a revenue source for the purpose of reporting within the Provider Relief Fund report and should not be reported as “other assistance received”.

- Both commercial organizations and non-federal entities are granted a six-month extension to the submission of audits that have a fiscal-year end through June 30, 2021. As a reminder, audits are due 30 calendar days after receipt of the audit report or nine months after the end of the audit period, whichever is earlier. On March 19, 2021, the Office of Management and Budget (OMB) Memo (M-21-20) extended the deadline for Single Audit submissions to six months beyond the normal due date, and on October 28, 2021, HHS granted the same extension to commercial organizations.

- HRSA is requiring Reporting Entities to report patient metrics to gather information on the number of patients treated by Provider Relief Fund recipients. Depending on recipient type, these patients may be treated in either inpatient, outpatient, or residential settings. These metrics enable HRSA to quantify respective volumes of inpatient, in-person, and virtual outpatient visits, as well as emergency visit patients. If a Reporting Entity does not believe their patient encounters align with one of the patient visit type options, the entity should count the distinct encounters or visits in the category that is the most fitting category available.

We will keep you posted as more is known. HW&Co. is here to assist you in any way we can. Please visit the HW&Co. Current Events Center on our website for additional resources or contact your HW Healthcare Advisor if you need assistance.

Disclaimer: Information in this article is subject to change and is based upon our current understanding as of the issue date. This is a constantly evolving process as HHS has been issuing new or changed guidance on a frequent basis.

Principal

paula.reape@hwco.cpa