The Ohio Department of Medicaid (ODM) has finalized the fiscal year (FY) 2022 Medicaid rates for Ohio nursing facilities (NF) effective 7/1/2021 to 12/31/2021 using the provisions in the biennium budget bill, HB 110, including a partial rebasing of peer group prices and additional funding for the quality incentive payments. The statewide average 7/1/2021 Medicaid rate was $226.44, which was an increase of $14.43 (6.8%) from the 1/1/2021 statewide average rate of $212.01. The rural peer group 3-S had the largest rate increase at 9.36%, while peer group 2-S had the smallest increase at 6.00%

The Ohio Department of Medicaid (ODM) has finalized the fiscal year (FY) 2022 Medicaid rates for Ohio nursing facilities (NF) effective 7/1/2021 to 12/31/2021 using the provisions in the biennium budget bill, HB 110, including a partial rebasing of peer group prices and additional funding for the quality incentive payments. The statewide average 7/1/2021 Medicaid rate was $226.44, which was an increase of $14.43 (6.8%) from the 1/1/2021 statewide average rate of $212.01. The rural peer group 3-S had the largest rate increase at 9.36%, while peer group 2-S had the smallest increase at 6.00%

Rate changes were primarily comprised of partial rebasing of peer group prices, the semi-annual case-mix adjustment using the average of the 12/31/2020 and 3/31/2021 Medicaid case-mix scores, and the recalculation of the quality incentive payments. FY 2022 rates will be recalculated on 1/1/2022 for the semi-annual case-mix adjustment using the average of the 6/30/2021 and 9/30/2021 Medicaid case-mix scores. See below for a summary of HB 110 NF provisions.

As always, the updated rates will impact payments for both traditional Medicaid and MyCare Ohio Medicaid residents. Be sure to review your MyCare payments carefully as the MyCare plans have had issues in the past.

Review your rate package for accuracy

Rate packages are not yet available in MITS due to an ODM problem printing them. Once they are posted, providers will have 30 days to file rate reconsideration requests. It is important that you review these calculations closely for possible errors and submit a timely request for reconsideration. Contact us if you need assistance.

HB 110 Summary

HB 110 added approximately $740 million to NF rates for FY 2022 (7/1/2021 to 6/30/2022) and FY 2023 (7/1/2022 to 6/30/2023). The scheduled rebasing of peer group prices is limited to $125 million per year and the quality incentive pool is $195 million in FY 2022 and $295 million in FY 2023.

Peer group prices for direct, ancillary/support, taxes, and capital were all scheduled to be rebased on 7/1/2021 based on the five-year rebasing schedule in Ohio law. Due to a $125 million cap in HB 110, Ohio was forced to limit rebasing of certain price components. While direct care prices were fully rebased, Ancillary/Support prices received only approximately 42% of their full rebasing allocation, and tax costs were not rebased. Capital prices will no longer be rebased during the 5-year price rebasing due to a provision in HB 110.

In addition, HB 110 eliminated the old 7 point quality system but it renewed and added funding to the 5165.26 quality incentive which had been scheduled to sunset at 6/30/2021. However, it excludes facilities from earning the quality incentive if they are below the 25th percentile of points earned (9.50 points) or are included on CMS’ Special Focus Facility list.

HB 110 also requires that providers spend 70% of the additional funding they receive from rebasing on direct care. The average rate increase due to rebasing was $8.60, approximately 61% of which was direct care. ODM is still developing the methodology to enforce this provision which could include an online, quarterly reporting process for direct care costs.

HB 110 did not renew the Certificate of Need (CON) restrictions that were in effect from 10/17/2019 through 6/30/2021. This is good news for facilities looking to file CONs for the relocation of existing beds or the replacement of existing facilities within the same county. In addition, the CON reviewability threshold for renovation projects was increased from $2 million to $4 million, allowing facilities to complete significantly more improvements without obtaining CON approval.

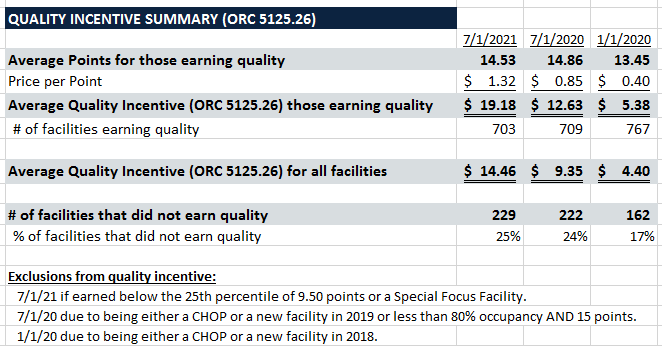

Quality Incentive Summary (ORC 5125.26)

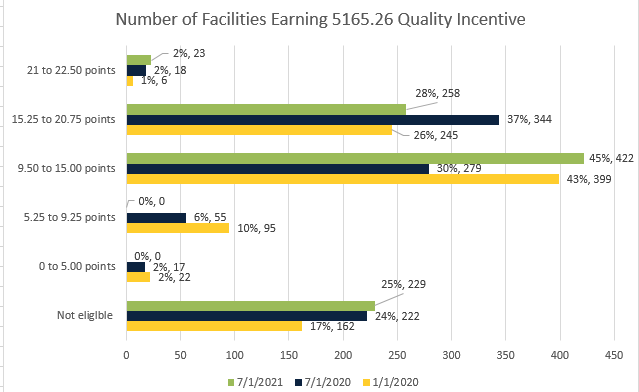

The average quality incentive increased to $14.46 from $9.35. This was primarily due to increased value per quality point of $1.32, up from $.85, resulting from the additional funding provided by HB 110. The average points earned decreased slightly to 14.53 from 14.86. There were 229 providers (25%) that did not receive a quality payment due to the provision excluding facilities that earned below the 25th percentile of 9.50 points and those included on CMS’ Special Focus Facility list. Unlike the two prior periods, changes of operator and newly certified facilities were not excluded from the quality incentive calculation. The quality incentive payment is effective for all of FY 2022.

The following charts provide more details on average points and number of facilities earning points:

How can we help?

Please contact us for assistance with any of the following:

- Reviewing your July 1, 2021 Medicaid rate

- Filing a rate reconsideration

- Detailed Ohio Medicaid rate history, case-mix, and quality analysis

- Benchmarking expenses, census, and staffing against selected competitors, as well as county, peer group, and statewide averages

- Medicaid and Medicare cost reporting and rate analysis

- Certificate of Need Projections

- Monthly billing services

- Accounts receivable aging review

- Assistance with Provider Relief Fund reporting

- Single Audits and other program-specific government audits

- Any other reimbursement, revenue cycle, accounting, or tax needs