The Centers for Medicare & Medicaid Services (CMS) published the final rule updating Medicare rates for skilled nursing facilities for federal Fiscal Year (FY) 2025 in the August 6, 2024 Federal Register. The rates will be effective from October 1, 2024 through September 30, 2025.

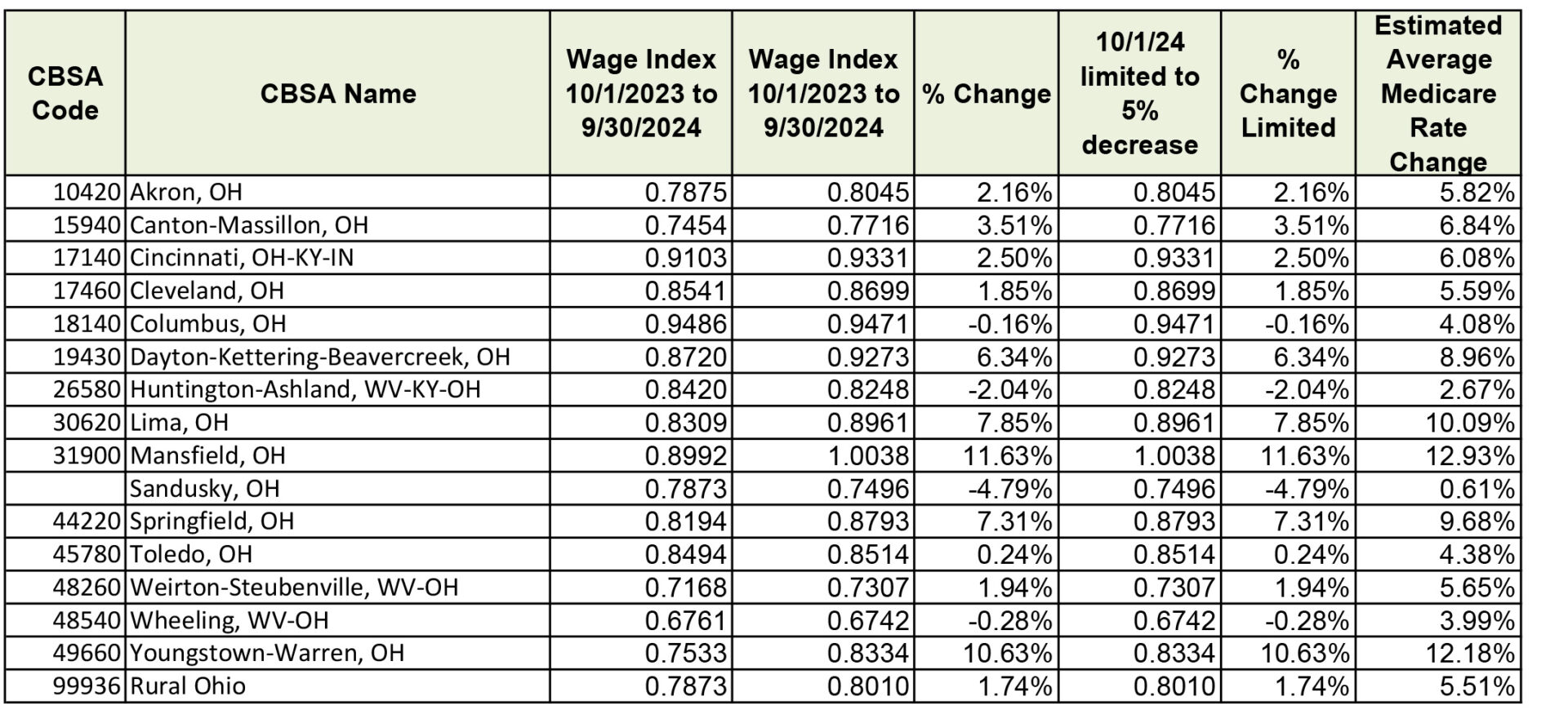

The FY 2025 final rule provides for a 4.2% net market basket increase over FY 2024, and as a result, net Medicare reimbursement is expected to increase nationwide SNF payments by approximately $1.4 billion. Due to annual updates in CBSA wage indices, your county’s change in Medicare rates may be higher or lower than the published 4.2% increase.

The wage indices of many Ohio CBSAs experienced increases, in some cases significant. As a result, the rates of several CBSAs are expected to increase between 6% and 8%, with some in excess of 10%. Your facility’s results may vary from our estimates below based on your PDPM utilization.

Effective October 1, 2024, CMS updated its CBSA delineations nationwide using recent Census Bureau information. The changes resulted in some CBSAs moving between the urban and rural designations, as well as the creation of new CBSAs and certain counties moving within urban CBSAs. Impacted counties in Ohio include:

- Erie County – moved from the Rural Ohio CBSA to the newly created Sandusky CBSA

- The Sandusky CBSA existed prior to 2021 when it was eliminated by moving Erie County to the Rural CBSA. The 2024 update reverses this change.

- Ottawa County – moved from the Toledo CBSA to the Sandusky CBSA

- Ashtabula County – moved from the Rural Ohio CBSA to the Cleveland, OH CBSA

Three Ohio CBSAs experienced updates to their names:

-

- Cleveland-Elyria, OH was changed to Cleveland, OH

- Dayton-Kettering, OH was changed to Dayton-Kettering-Beavercreek, OH

- Youngstown-Warren-Boardman, OH-PA was changed to Youngstown-Warren, OH

- Mercer County, PA was removed from this CBSA

The final rule also made adjustments to the technical mapping of certain conditions between ICD-10 diagnoses and PDPM groupings. CMS has posted an updated PDPM ICD-10 mapping file on its website to assist providers with coding crosswalks and classification logic.

PDPM continues to be complex and it is critical to ensure facility staff stay abreast of the clinical and billing requirements. We are available to assist you with any questions or issues you may have. Please contact us if you are in need of assistance.

PDPM RATES EFFECTIVE 10/1/2024

The links in the list below provide the detailed calculations of the PDPM rates for each of the 16 CBSAs in Ohio. The rates provided for the individual CBSAs are shown prior to the Quality Reporting Program and Value Based Purchasing adjustments.

Please select the CBSA from the list below in which your county resides to open a printable PDF file. If you are not sure which CBSA to choose, please click the first link to open a crosswalk between the county names and the CBSA names.

DETAILED CALCULATIONS BY OHIO CBSA NAME

- Akron

- Canton-Massillon

- Cincinnati

- Cleveland

- Columbus

- Dayton-Kettering

- Huntington-Ashland (Lawrence County, OH)

- Lima

- Mansfield

- Rural Ohio

- Sandusky (Erie County)

- Sandusky (Ottawa County)

- Springfield

- Toledo

- Weirton-Steubenville (Jefferson County, OH)

- Wheeling, WV (Belmont County, OH)

- Youngstown-Warren

Note: CMS limits a reduction in a county’s wage index to 5% year-over-year. The limit is applied at the provider level, not at the CBSA level. As a result of Ottawa County’s move to the Sandusky CBSA from the Toledo CBSA, it would have experienced a decrease of approximately 11% in the absence of the limitation. As a result, the wage index for Ottawa County is limited to a 5% reduction, necessitating different rate files for the two Sandusky CBSA counties.

We have developed a calculator to assist in calculating rates for all PDPM groups. The calculator can assist you in seeing changes in reimbursement over the course of a Part A stay due to the potential impacts of tapering and AIDS diagnoses. Please contact us for more information if you are interested.

These rates are subject to change. If a Correction Notice is issued that affects any Ohio counties, we will update our website links with the new rates.

SNF VALUE BASED PURCHASING PROGRAM

The final rule also included several updates to the SNF VBP program include the following:

- Adoption of several administrative policies including:

- A policy covering the selection, retention and removal of VBP metrics beginning with the FY 2026 program year.

- A policy to incorporate technical updates into measure specifications in the sub-regulatory process

- Administrative updates to the SNF VBP review and correction process and the extraordinary circumstances exception policy.

SNF QUALITY REPORTING PROGRAM (QRP)

The SNF PPS Final Rule included several changes to the SNF Quality Reporting Program. The QRP requires SNFs to meet a minimum threshold of satisfactory MDS reporting and quality measures data. Facilities who fail to do so are penalized 2% of their PDPM rates. Facilities are not penalized for performance on the measures.

SNF QRP Update

Updates to the SNF Quality Reporting Program to be implemented beginning in the FY 2027 SNF QRP:

- Collection of four new items as under the social determinants of health (SDOH) category, including living situation, two food items, and utilities.

- Modification of the transportation item under the SDOH category.

- Implementation of a required validation process for assessment-based measures. The validation process will include up to 1,500 SNFs per year for manual auditing of QRP data. Failure to cooperate will result in a 2% reduction in PDPM rates.

- Applying the Medicare Administrative Contractor’s (MAC’s) existing validation process for the SNF QRP claims-based measures.

Please see the FY 2025 SNF PPS Final Rule for additional information on each of these measures.

CMS is increasing the SNF QRP Data Completion thresholds for the Minimum Data Set (MDS) Data Items beginning with the FY 2026 SNF QRP. SNFs must report 100% of the required quality measure data and standardized resident assessment data collected using the MDS on at least 90% of the assessments they submit to CMS. Any SNF that does not meet the requirement will be subject to a reduction of two percentage points to the applicable FY annual payment update beginning with FY 2026.

HW HEALTHCARE ADVISORS

Our team consists not only of CPAs, but also highly trained and experienced billing/revenue cycle consultants, certified medical office managers and LNHAs. We are dedicated to working with the regulatory, operational and reimbursement challenges that providers face in an ever-changing healthcare environment.

We can assist you in streamlining your processes, optimizing your operations and identifying potential opportunities and risks. Please contact any of our HW Healthcare Advisors to discuss how we can help you and your facility stay on the path to success.