The 9/30/2021 reporting deadline for Provider Relief Funds (PRF) received between 4/10/2020 and 6/30/2020 is rapidly approaching. It is important to understand the reporting requirements and to be prepared before entering information into the PRF Reporting Portal. Quarterly information is required for expenses, patient care revenues and staffing FTEs so if you haven’t already gathered the information you should start soon. This article is a high-level overview of the reporting steps. There are still some unknowns and areas in which we are hoping for clarification. We have developed a calculation tool to help you plan your report and run through what-if scenarios for your organization. Please contact us for more information about this valuable tool.

The 9/30/2021 reporting deadline for Provider Relief Funds (PRF) received between 4/10/2020 and 6/30/2020 is rapidly approaching. It is important to understand the reporting requirements and to be prepared before entering information into the PRF Reporting Portal. Quarterly information is required for expenses, patient care revenues and staffing FTEs so if you haven’t already gathered the information you should start soon. This article is a high-level overview of the reporting steps. There are still some unknowns and areas in which we are hoping for clarification. We have developed a calculation tool to help you plan your report and run through what-if scenarios for your organization. Please contact us for more information about this valuable tool.

PRF REPORTING STEPS:

Step 1: Register in the PRF Reporting Portal. You must complete the registration in one session. If you exit prior to completion, you will need to start the registration over.

Step 2: Read the Reporting Requirements Notice and visit the HRSA Reporting and Auditing webpage for tutorials, user guides, webcasts and other resources.

Step 3: Gather information that will need to be reported. The portal is comprised of the following sections:

- Reporting Entity Business Information

- Subsidiary Questionnaire

- Acquired/Divested Subsidiaries

- Payments to Recipients (will auto-populate, may need to resolve discrepancies)

- Interest Earned on PRF Payment(s)

- Tax and Single Audit Information

- Other Assistance Received **

- Use of Nursing Home Infection Control Payments **

- Use of General and Targeted Distribution Payments **

- Unreimbursed Expenses Attributable to Coronavirus **

- Actual Patient Care Revenue. Annual amount entered if lost revenue not needed.

- Lost Revenues Attributable to Coronavirus **

- PRF Financial Summary (populates based upon values entered. Be sure to print and save.)

- Personnel, Patient, and Facility Metrics **

- Survey Questions

- Review and Submit (provides a summary of all data entered but can only reach if all prior pages complete)

** Use HRSA Excel Reporting Worksheets to gather information by quarter.

Step 4: Enter information in Reporting Portal. Can save information and return later but must advance through each section listed above in order.

Step 5: Review and Submit. Be sure to review information for accuracy before submission. You will have 30 days to return any unused funds.

KEY REMINDERS:

- No Double Dipping: Expenses and lost revenues can only be applied to one source of funds and PRF funds are to be used last. Therefore, COVID related expenses used for PRF are to be reported NET of any other COVID assistance (e.g. PPP, Ohio CRF, ERTC, etc.).

- Lost Revenue Calculations: The portal allows for three options: 1) comparison of actual-to-actual quarterly net patient revenues; 2) comparison of actual-to-budget quarterly net patient revenues; or 3) other reasonable method. Option 2 requires your budget to have been approved and in place by March 27, 2020 (with an Executive Level attestation,) and you will be required to upload your budget with the reporting submission. Option 3 requires a narrative explaining the methodology is reasonable and a description of why the lost revenues were attributable to coronavirus (as opposed to a loss caused by any other source). CMS has the right to deny an Option 3 submission and require a provider to resubmit using either Option 1 or 2. HRSA recently added this Lost Revenues Guide with examples.

- Document, Document, Document: To be considered an allowable expense under the Provider Relief Fund, the expense must be used to prevent, prepare for, and respond to coronavirus. Provider Relief Fund payments may also be used for lost revenues attributable to the coronavirus. Reporting Entities are required to maintain adequate documentation to substantiate that these funds were used for healthcare-related expenses or lost revenues attributable to coronavirus, and that those expenses or losses were not reimbursed from other sources, and other sources were not obligated to reimburse them. HRSA recently added this Allowable Personnel Expenses guide with examples.

- Infection Control Expense Considerations: SNF Infection Control targeted distributions were not received until reporting period 2. Generally, infection control expenses should be excluded from the Period 1 report and included in Period 2, unless you don’t have enough other expenses and lost revenues to justify Period 1 funds received. Lost revenues cannot be used to support infection control funds. Allowable infection control expenses are limited to costs associated with administering COVID-19 testing; reporting COVID-19 test results to local, state, or federal governments; hiring staff to provide patient care or administrative support; providing additional services to residents; or other expenses incurred to improve infection control.

- Targeted Distribution Transfers: The portal is not designed for reporting the use of funds for transfers of targeted distributions. We are still hoping for better guidance. Please contact us for the latest recommendations.

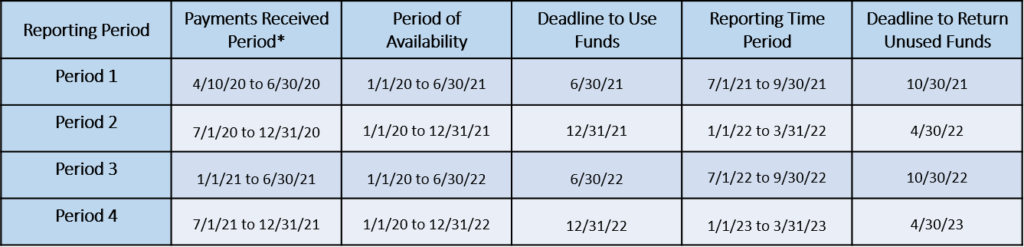

- Plan for Future Reports: As you complete the Period 1 report, you should plan for future reporting. Early reporting is not allowed. Unused expenses and lost revenues can be used in future periods. The table below details the four reporting periods:

*Reporting required if payments received in a reporting period exceed $10,000 in aggregate.

Click here or contact your HW Healthcare Advisor directly if you have questions or want information about our PRF calculation tool.

Disclaimer: Information in this article is subject to change and is based upon our current understanding as of the issue date. This is a constantly evolving process as HHS has been issuing new or changed guidance on a frequent basis.

Principal

preape@hwco.com