If you have not begun the process of gathering your information, you will want to start. The HB45 reporting deadline for Cycle 1 reporting is coming soon, July 31st. All providers received an email from the Ohio Office of Budget and Management (OBM) with reporting information last week; in case the email is lost in your spam filter we have included a link to the Reporting Job Aid & Template Instructions.

If you have not begun the process of gathering your information, you will want to start. The HB45 reporting deadline for Cycle 1 reporting is coming soon, July 31st. All providers received an email from the Ohio Office of Budget and Management (OBM) with reporting information last week; in case the email is lost in your spam filter we have included a link to the Reporting Job Aid & Template Instructions.

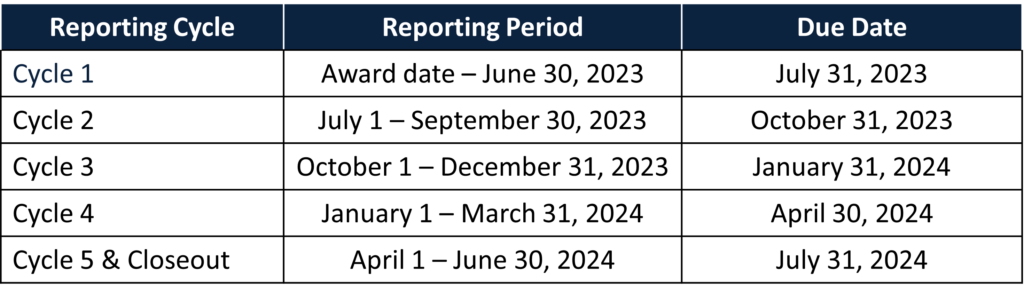

In addition, OBM provided this webinar link. Providers must report activity within the reporting period the funds are expended. In Cycle1 providers will report expended funds from January 27, 2020 through June 30, 2023. If you have expended all funds in Cycle 1 you will not need to report in subsequent cycles. If you have not expended all funds through June 30, 2023 you will justify expenses in subsequent cycles.

For your convenience, we have created a template that summarizes the steps in the job aid with clarifying notes and fields to make data entry in the reporting portal easier. Please contact us if you would like a copy.

With the official instructions issued and the due date approaching, we wanted to provide a few reminders about the funds, their uses, and the reporting.

Overview

The Workforce Relief Program targets challenges the industry faces because of the pandemic, specifically increased labor costs, and staffing shortages from either staffing losses or the inability to attract staff.

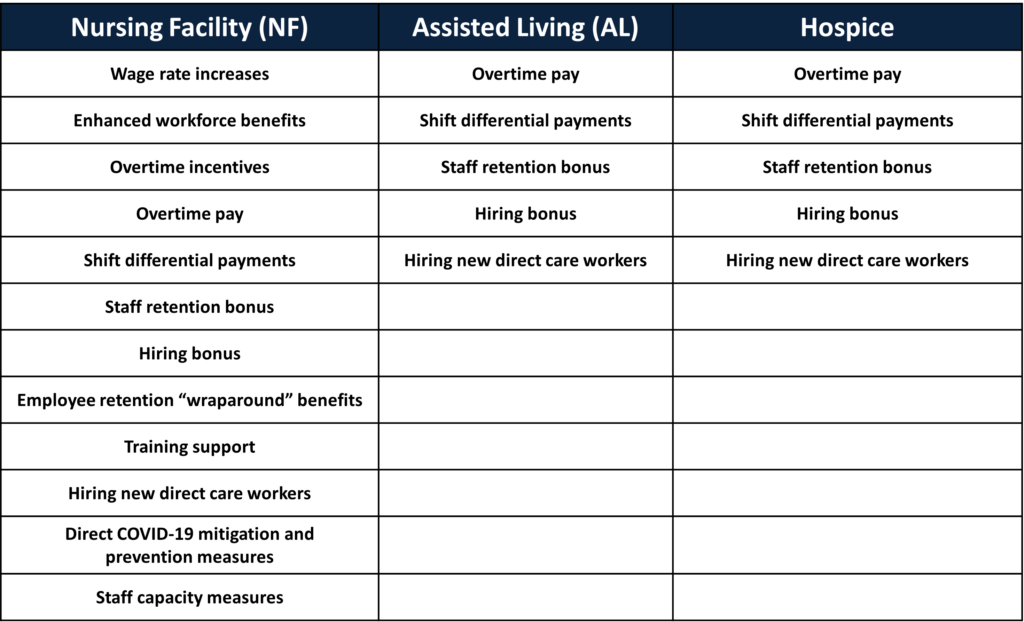

The permissible uses of the funds are as follows:

Funds can be used to cover any of the above permissible expenses going back to January 27, 2020 as long as these expenses were not covered by other pandemic relief funding i.e. no double dipping. This first reporting cycle should include any permissible expenses incurred through June 30, 2023 that have not been previously used to justify other funds.

Additionally, the types of expenditures not permitted are as follows:

- Costs not related to workforce impacts as a result of the pandemic

- Costs incurred prior to January 27, 2020

- Costs already reimbursed by another source (i.e. No double dipping)

- Costs used to match other federal grant programs

- Payments to shareholders, members, partners, or any other owner/equity holders

- Payments of nonbusiness expenses

- Payments for taxes, fines, government levies, or political activities

- Payments of debts, settlements, or judgments

- Payments to support efforts that conflict with or contravene the purpose of the American Rescue Plan Act statute.

Reporting

Providers will report on the use of funds in each of the allowable categories listed above in an Excel reporting template. For each allowable expenditure category, there is a sheet with the information required and the template will be uploaded to the Ohio Grants Portal, we have provided links to the Excel template below. In some instances, the details will require four years of data from 2020 through 2023. For example, Total FTEs as of January 1, 2020, 2021, 2022, and 2023. Keep in mind that quarterly FTE data was submitted with Provider Relief Funds (PRF) reporting. Although PRF was in a different format, you may have the detail needed for HB45 in your 1st quarter FTE calculations for PRF. At a minimum, you want to ensure metrics such as FTEs make sense between the two reporting submissions i.e. PRF and HB45.

The information reported is subject to additional requests for supporting documentation or audit. You should maintain all documentation to support reported expenditures as an appropriate use of funds and show funds were not also reported as a use of funds for other pandemic-related funding.

The Workforce Relief Program Guidance and Frequently Asked Questions document provides definitions and greater detail on the use of funds and reporting, and should be referenced prior to submitting your information. If you do not already have this document or the Excel reporting template, please use the link below to obtain a copy for your provider type.

| Nursing Facility (NF) | Assisted Living (AL) | Hospice |

| NF Reporting Template (Excel) | AL Reporting Template (Excel) | Hospice Reporting Template (Excel) |

| NF Guidance & FAQ | AL Guidance & FAQ | Hospice Guidance & FAQ |

The Ohio Grants Portal will be undergoing an upgrade in August which will impact reporting access. Recipients that do not file by the deadline may be required to transition to new log-in credentials. Information on the portal upgrade will be communicated to recipients in mid-August.

If you have questions on the use of funds and reporting or would like to discuss any items in this article, please contact your HW Healthcare Advisor.

Senior Manager

helen.weeber@hwco.cpa