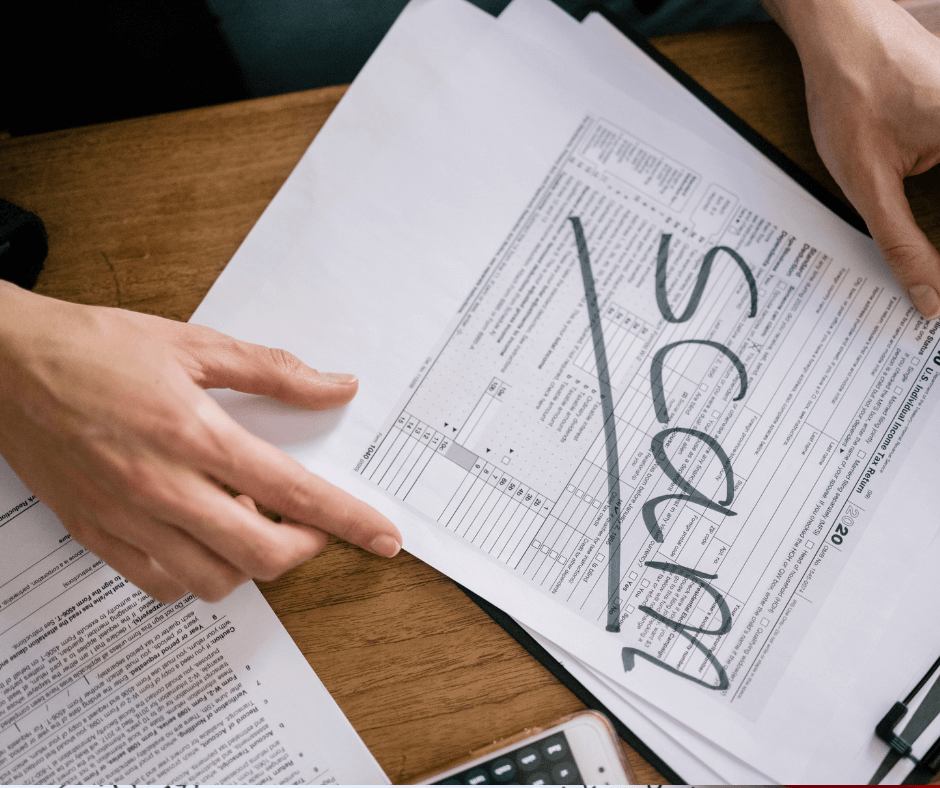

Early Revenue Recognition: Not Just Bad Accounting, but Fraud

Financial statement fraud is the least common type of occupational theft (9% of incidents), yet it causes the most substantial financial losses for businesses, according to the Association of Certified […]