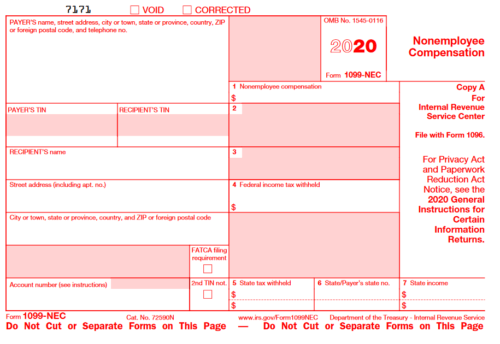

The IRS has officially unveiled the new 1099-NEC form. Beginning with tax year 2020, filers must use Form 1099-NEC to report any non-employee compensation.

The IRS has officially unveiled the new 1099-NEC form. Beginning with tax year 2020, filers must use Form 1099-NEC to report any non-employee compensation.

This form replaces form 1099-MISC Box 7, which has previously been used to report non-employee compensation. To see the new form and its complete instructions, visit the IRS website.

For the 2020 tax year, Form 1099-NEC is due February 1, 2021 to both the recipient and the IRS. We are still awaiting guidance from the State regarding e-filing.

Also, note that payments to attorneys are now included on Form 1099-NEC. These were previously reported on 1099-MISC, box 7.

Contact your HW&Co. Tax Advisor with questions.